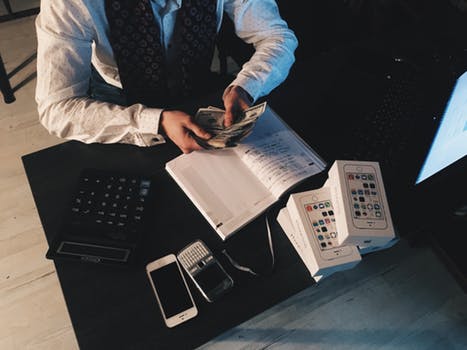

Accounting is the essential financial compass for businesses, large and small. But it’s often met with a sigh. What if you could unload that burden? Enter outsourcing accounting services game-changer where daunting number crunching blossoms into a strategic business move. It’s like having an invisible financial superhero guiding your business toward profitability and growth.

Understanding Outsourcing Accounting Services

Outsourcing accounting services is like ordering pizza. Instead of shopping, prepping ingredients, and fussing with the oven, you get a piping hot pizza delivered right to your door. Simply, it means you delegate duties, like tracking revenue and expenses, filing tax returns, and processing payroll, to an external expert or agency. This compares favorably to an in-house team that usually comes with higher costs and complexities.

Businesses Benefiting Most from Outsourcing Accounting Services

Small Businesses

Ever played Tetris on a calculator? Well, that’s often what managing a small business feels like you’re strapped for resources! Outsourcing accounting services steps in like a tactful Tetris champ, consolidating resources and thus allowing small businesses to focus on core operations rather than the tricky realm of finances.

Startups

Startups, on the other hand, burst onto the scene with a sizzling idea. Yet, they often need guidance navigating the financial landscape. Outsourcing emerges as a reliable GPS, steering startups away from potential financial pitfalls towards smooth sailing success.

Key Benefits of Outsourcing Accounting Services

Outsourcing accounting services is like having your cake and eating it too’s cost-effective, saving you the expense of a full-time salary or team. Plus, you gain access to a pool of professionals wielded with industry knowledge, essentially, state-of-the-art financial guidance at your fingertips. Handing over your accounting also ensures compliance with tax laws and regulations.

That’s right, wave goodbye to accounting shenanigans and rest easy knowing your business remains within the lines of legalities. Furthermore, it presents scalability. As your business grows, your accounting requirements will undoubtedly follow suit. Outsourced services can be easily adapted to cater to this growth, acting like an elastic tie that expands in line with your business. A telling sign of a business’s health is its financial reports.

Outsourced services typically provide detailed reports, offering you an in-depth analysis and understanding of your financial position. Imagine being given a map that shows you where you stand and the many roads to profitability. Adding to this, outsourcing can also offer a reduction in risks. Leaving accounting to the experts minimizes the chance of errors and provides enhanced security for financial data.

Outsourcing Accounting’s Place in Accounting Software

Think of accounting software as a first-rate sous-chef, slicing and dicing financial data efficiently. When coupled with outsourcing, this duo becomes an unstoppable powerhouse. Tasks like payroll services and tax preparation become streamlined, optimizing operational efficiency.

Benefits of Bookkeeping Solutions

Having a dedicated bookkeeping solution is like having a personal organizer for your finances. And with a trusty website to handle bookkeeping tasks, management of invoices and payroll duties becomes incredibly efficient. This not only saves valuable time but also boosts accuracy.

Whether you’re chasing the financial health of a small business or a global enterprise, outsourced accounting services can be a silver bullet. It’s like having a financial guru navigating your business journey, even if you’re located in areas such as bookkeeping in Cambridge, ON.

Conclusion

To wrap it up, think of outsourcing your accounting services as a strategic move on the chessboard of business. From startups to small businesses and even larger entities, all can harness its benefits for cost-effective, expert financial management. Now, is it time to consider how outsourcing could elevate your business? Remember, the bottom line is just the beginning.